House buying programs for bad credit

2 days agoStep Six. Like any other mortgage you can get pre-approved for an FHA loan.

Pin On Diy Tips

Second chance auto loans help you buy a car and fix your credit score.

. Pre-approval can help you save time and narrow your search as you. Buying a House with Bad Credit. The typical PMI premium rate ranges from 058 to 186 of the original loan amount depending on your credit score until you have repaid 20 of the loan.

The 25000 Downpayment Toward Equity Program Expected in 2022. Most conventional lenders require a credit score of at least 620 to qualify for a mortgage. If individuals cant get approved for conventional mortgages then FHA loans are the remaining option for hopeful homebuyers with bad credit.

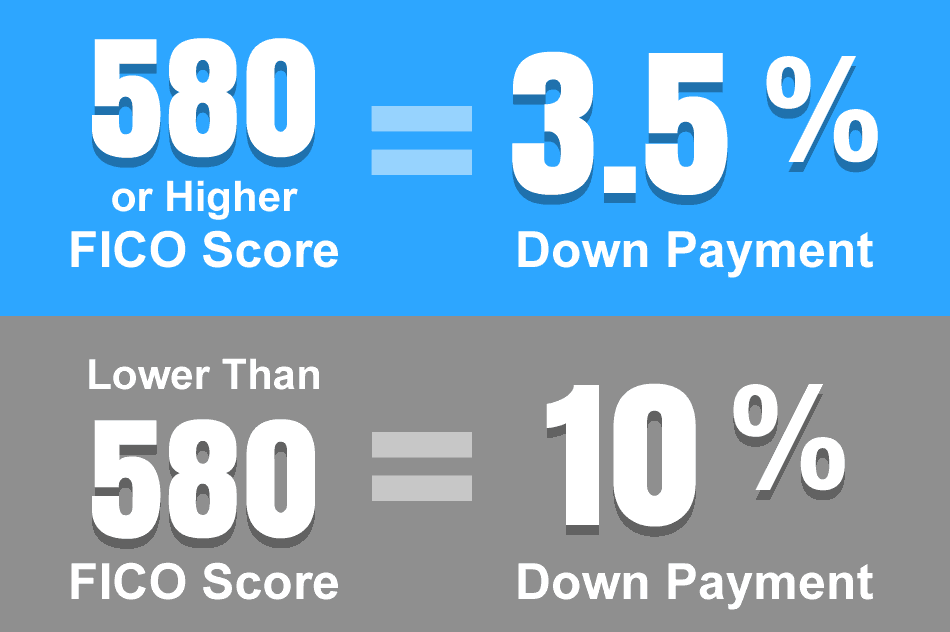

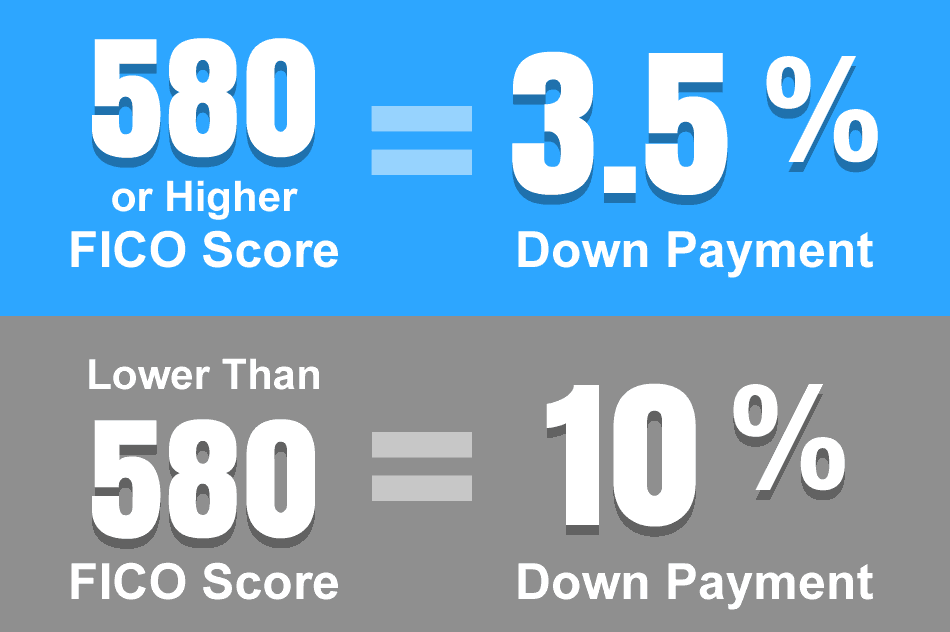

Buyers with credit scores of 580 or higher may be eligible for a down payment of 35 percent of the. FHA vs Conventional Loan Comparison Chart. Any time an application is filled out to rent an apartment the landlord or apartment complex will likely check the credit report and rental history to ensure the person will be a great rental.

Your credit utilization rate is how much you currently owe divided by your. The credit score needed to buy a house depends on the type of loan. Whether youre a seasoned real.

Try To Get Pre-approved. Guaranteed Rate has mortgage options for homebuyers with credit scores of 580 or above and all mortgage programs are available to borrowers with a credit score of 620 or above. Home Loans For All Approved Lenders work with 580 Credit Scores.

Rocket Mortgage is a name you probably know its Americas largest mortgage lender. Keep your credit utilization rate low. When it comes to buying a home a bad credit score generally falls below 620.

Whether your credit score is 500 or less a car is within your reach. Contact your state housing finance agency or state HUD office for information about special programs administered by your state and properties available in your area. Best For an Easy Online Process.

You should also keep your credit utilization ratio below 30. FHA loan requirements are. In 2021 Congress introduced a bill titled The Downpayment Toward Equity Act a home buyer grant for.

Department of Housing and Urban Development 451 7th Street SW Washington DC 20410 T. Direct Access to the HUDHomestore and Real-Time Mortgage Rates. Department of Housing and Urban Development.

Loans backed by the Federal Housing Administration are available nationwide.

How To Buy A House With Bad Credit Growthrapidly Bad Credit Buying First Home Buying Your First Home

Five Things I Wish I Had Known Before I Bought A House Home Buying Sell My House Home Buying Process

What Are Fha Loans For Bad Credit Fha Loans Loans For Bad Credit Refinance Mortgage

100 Financing Zero Down Payment Kentucky Mortgage Home Loans For Kentucky First Time Home Buyers Wha Bad Credit Mortgage Loans For Bad Credit No Credit Loans

You Can Now Buy A Home In Arizona With 0 Down Zero Down Home Loans Available Contact Nicholas Mcconnell With Realty O Arizona Home Buying Bank Owned Homes

Pin On Real Estate Tips For Buyers

Bad Credit Mortgages 2020 Bad Credit Lenders Bad Credit Mortgage Bad Credit Mortgage Lenders Credit Repair

Credit Score Information For Kentucky Home Buyers Mortgage Loans Good Credit Good Credit Score

How To Buy A House With Bad Credit In 2022 Tips And Tricks

Bad Credit No Credit Rent To Own Homes Finding A House Home Buying

Trustlink Mortgage Broker Plano Tx Mortgage Lenders Mortgage Brokers Va Loan

How To Buy A Home With Bad Credit And No Money For Most People Who Suffer From Poor Credit Scores No Credit Sco Loans For Bad Credit Credit Repair Bad Credit

How To Buy A House With Bad Credit Nerdwallet

Minimum Credit Scores For Fha Loans

Pin On Mycreditbridge Com

Can You Still Get A Mortgage With Bad Credit Realtybiznews Real Estate News Bad Credit Mortgage Mortgage Tips

How To Buy A House With Bad Credit In 2022 Tips And Tricks